It has become common practice for the political left to use the redefinition of words combined with new legislation and lawsuits to achieve political goals that would be out of reach if the public understood the tools of manipulation that were being used against it.

“Women” is a word that no longer means what you think it means. “Dangerous domestic terrorists” refers to parents speaking to their school boards. A violent riot that destroys property and lives is redefined as a “peaceful protest.” An actual peaceful protest is redefined as an “insurrection.” A drug-crazed thug is redefined as a “hero.”

Everywhere we look, we see the political left manipulating language. This is happening at schools, in the arts, movies, entertainment, on social media, in the news and even at the Legislature. The progressive left writes laws with the manipulated language in a way that allows it to accumulate power and destroy our society. It’s just like a magic trick in Times Square. You are the gullible mark; they are the language magicians.

Today’s Washington State example is “Income Tax” vs. “Excise Tax”

History of Income Tax in Washington State

Our state constitution clearly states that “All taxes shall be uniform upon the same class of property” and that “The word ‘property’ as used herein shall mean and include everything, whether tangible or intangible, subject to ownership.” We learn from the secretary of state that “Washington voters have been asked on 11 separate occasions to adopt a state personal income tax or corporate income tax. Only the first vote, in 1932, was successful, and that measure was subsequently thrown out by the state Supreme Court on a 5-4 decision on September 8, 1933.”

The state Supreme Court has also stated in multiple rulings that the constitution needs to be amended if a graduated income tax is to be imposed in Washington. Washington voters have rejected constitutional amendments and ballot initiatives ten times since 1933.

Finally, it’s important to know the IRS defines a capital gains tax as an income tax: “...You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such.”

The political left never gives up

One thing that I respect about the political left is that it never gives up on an issue. Even after 11 legal setbacks on a state income tax, they were back at it in the 2021 session with ESSB 5096, which tried to redefine an “income tax” as an “excise tax”. The argument is basically that income isn’t property (meaning you don’t own it). That’s surprising, since the definition of property in the state constitution is pretty clear.

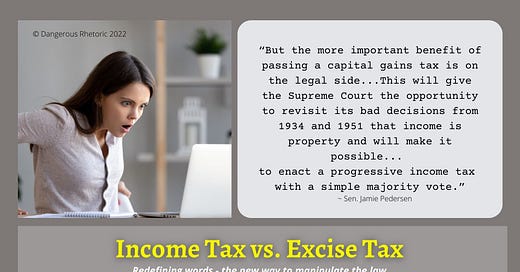

According to public records requests, the Democrats’ “redefinition strategy” is deliberate. Sen. Jamie Pedersen wrote to colleagues: “... This will give the Supreme Court the opportunity to revisit its bad decisions from 1934 and 1951 that income is property and will make it possible… to enact a progressive income tax with a simple majority vote.”

Where we are now

In March of 2022, a judge in Douglas County Superior Court ruled that the capital gains income tax adopted in ESSB 5029 is an unconstitutional graduated income tax. The judge pointed out that the tax was levied annually (like an income tax), not at the time of each transaction (like an excise tax).

On July 13, “The state Supreme Court agreed...to take direct review of the capital gains income tax case (bypassing Court of Appeals).” The date for this new hearing has not yet been set. Will the supreme court agree with the word magicians, or with the words as defined in our constitution?

Don’t give up hope, take action!

We can fix our government. Keep your eyes on the prize, and look for positive, non-violent ways to take action. Channel your frustration into peaceful but constructive local actions! What you focus on expands, so focus on taking small, positive local actions at every opportunity. Here’s a few ideas:

Support Opportunity for All Coalition. “The Opportunity for All Coalition (OFAC) is a non-profit 501c4 organization whose mission is to win a legal challenge to strike down Washington state’s illegal capital gains income tax.” Legal battles are not cheap, and they’re fighting for you! If you would like to support them financially you can make a donation on their website home page.

Support the Washington Policy Center. This issue is just one of many that this valuable group is tracking.

Sign the Let’s Go Washington Initiatives. Initiative I-1491, would repeal the capital gains tax.

Now is the time to talk to your friends, neighbors and countrymen. Now is the time to support candidates who are dedicated to making America great again. Now is the time to research the candidates you will get to vote for in November. There’s lots of positive things to do as we work to save our republic.

Nancy Churchill is a writer, educator and marketing consultant in rural eastern Washington State, and the state committeewoman for the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own.

If you enjoyed this edition of Dangerous Rhetoric, please subscribe for free to receive this column in your email. If you'd like to hit the tip jar, it's always greatly appreciated.

Other Platforms:

LinkedIn: https://www.linkedin.com/newsletters/dangerous-rhetoric-6944718972495814656/

Truth Social: https://truthsocial.com/@nancydchurchill

Thinkspot: https://thinkspot.com/dangerousrhetoric

Rumble: https://rumble.com/c/c-1804511