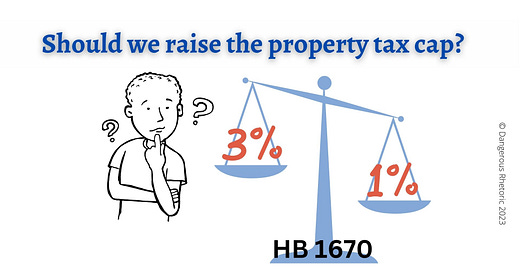

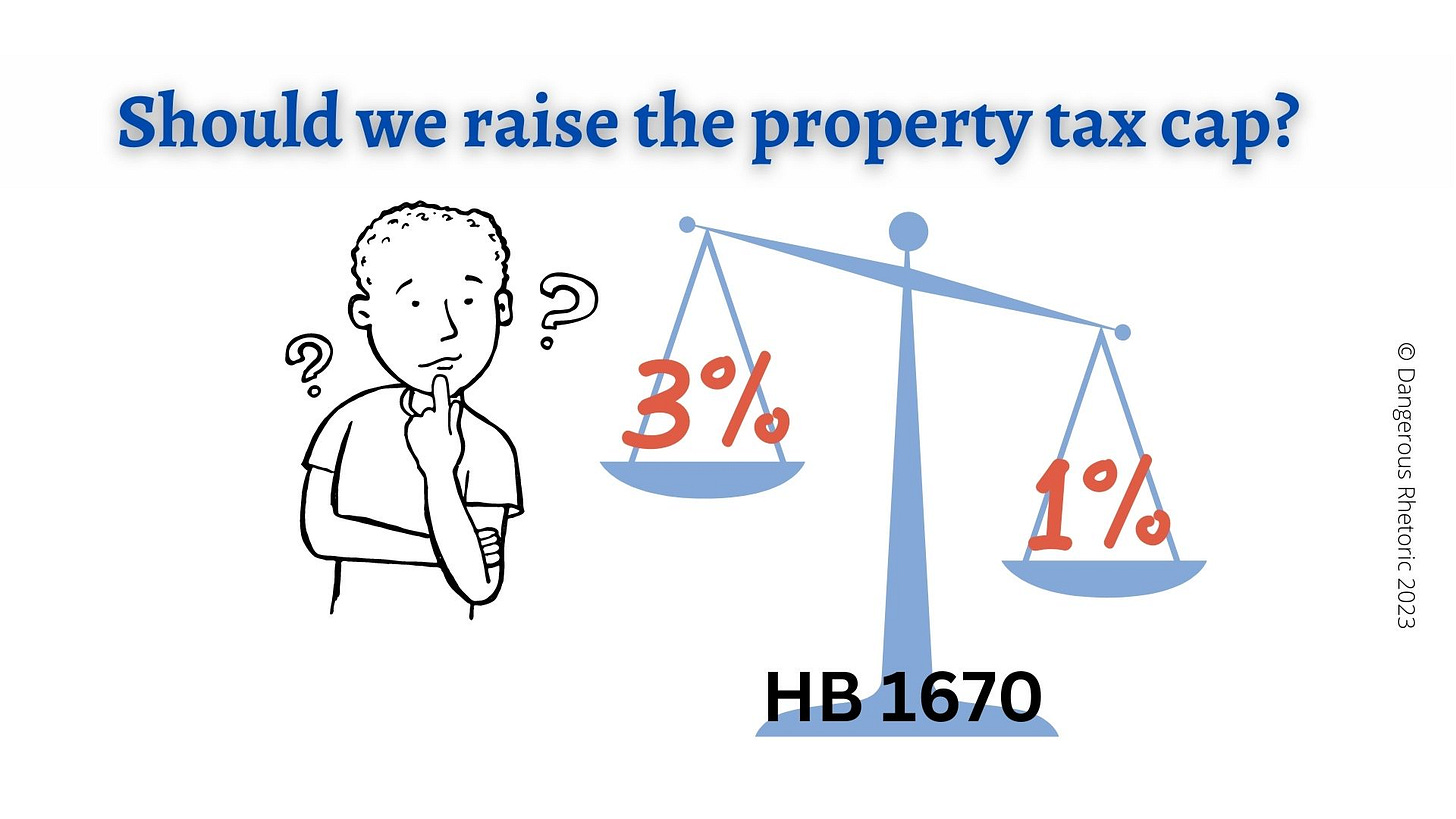

In 2007, state legislators enacted legislation which limited cities, counties, schools and special districts from increasing property tax collections by more than one percent from one year to the next, unless voters approved a larger increase. At the time, the maximum was six percent. Special levies must be approved by the voters.

House Bill 1670 would erase the one percent limit and repeal portions of the state law passed in 2007. As proposed, property tax increases would be tied to the annual rates of inflation and population change, with a new cap of three percent.

Typically, a property tax increase would be considered in the course of adopting a new budget. Current law requires the taxing district hold a public hearing on such revenue sources. House Bill 1670 keeps that requirement in place assuring city councils and special tax districts would decide in public whether to utilize the authorized property tax increase.

Local governments struggle with inflation, too!

On one hand, small local governments are being squeezed hard by inflation—just like the taxpayers. For most taxing districts, payroll and payroll benefits are the biggest expense. County employees are hard to retain or attract to the county, because there’s just not enough revenue to offer competitive salaries. Time and time again, promising new hires that received valuable training, leave the county for a better offer. And who can blame them? All supplies, equipment and fuel are also skyrocketing in price, further draining scarce resources.

In areas that have received a large number of new residents fleeing from more expensive areas of the state, there is a higher demand for services than the local government may be staffed to handle. The need is great but the budget to increase staffing is just not there.

Housing price inflation already increased property taxes

On the other hand, skyrocketing housing prices due to very limited supply are causing the assessed property values for all property owners to jump to new heights. As a result, just because of the increase in property values, taxpayers are seeing their property taxes jump, sometimes more than 10%. In areas with a large number of rental properties and fixed-income property owners, these most vulnerable residents are struggling to cover the increased taxes.

Because of increased valuations, the revenue from property tax collections will provide local taxing districts with some much needed additional revenue. Because of this, is it really necessary to increase the tax cap to three percent?

Actions you can take today

HB 1670 is currently in the House Rules Committee, waiting for a decision that would send it to the floor for debate. There are several actions you can take today to impact this bill. First, visit the Bill Info Page and “Comment on this bill”. This will let your elected representatives know your position if this bill comes up for a floor vote.

Next, you can email chair of the House Rules Committee, Rep. Laurie Jinkins at laurie.jinkins@leg.wa.gov. Politely urge Rep. Jinkins, the speaker of the house, to consider your position on increasing the property tax limit factor. You might also cc House MinorityLeader JT Wilcox at jt.wilcox@leg.wa.gov.

Whether you love it or hate it, you CAN have an impact on HB 1670—and your future property taxes—when you write to the lawmakers in Olympia.

Nancy Churchill is a writer and marketing consultant in rural eastern Washington State, and the state committeewoman for the Ferry County Republican Party. She may be reached at DangerousRhetoric@pm.me. The opinions expressed in Dangerous Rhetoric are her own. Dangerous Rhetoric is also available on Rumble.