What is inflation? Do you remember the old Star Trek episode, “The Trouble with Tribbles”? In the beginning, everyone loved the cute and adorable tribbles. They were valuable, sought after and became a type of trading item. Unfortunately, they multiplied exponentially, and soon, there were far too many of them. As the number of creatures increased, they became less and less valuable. Almost overnight, they transformed from a sought after commodity to an underfoot nuisance. If dollars were tribbles, the loss of the value is inflation.

John Steele Gordon explains in “Inflation in the United States” that “As the price of money falls, the price of every other commodity must go up” (bit.ly/3NhnDB8). Gordon explains that “when the economy went into a deep recession with the bursting of the housing bubble in 2008... the government began running unprecedented budget deficits. The national debt, over $10 trillion in 2010, would double by 2017. With the onset of the COVID pandemic in 2020, the US deficits soared further as the government sought to mitigate the effects of shutting down much of the economy.”

Gordon continues, “With the Biden administration continuing pandemic relief, which discouraged many from seeking work, and restricting oil and gas production, inflation set in. Supply chain disruptions also contributed.

“By December 2021, consumer prices were up seven percent on an annual basis, the highest in 40 years, while producer prices were up 9.6 percent, the highest since that statistic has been compiled. And the expectation of further inflation is now deeply embedded in the economy.”

In a Wall Street Journal opinion, “It’s Joe Biden’s Inflation,” the editorial board points out that real wages are also falling. “A separate Labor report on Thursday found that real average-hourly earnings fell 0.8% for the month. Real wages have fallen in nine of the last 12 months... That wallops low-income workers in particular because they pay a larger share of their wages for the household basics of food and energy, which are both rising fast (on.wsj.com/3L1e8E0).

While your wages may have gone up a little, the prices of the things you need to survive—transportation, energy, food and housing—have gone up even more. Because of inflation, you’ve got less purchasing power, not more.

Who benefits from inflation? Debtors. Imagine that you borrow one hundred dollars from a friend to buy a tank of gas. When you get paid, you give him back one hundred dollars. But by then, because of inflation, your kind-hearted friend can only buy ¾ of a tank of gas. Because of inflation you won and your friend lost.

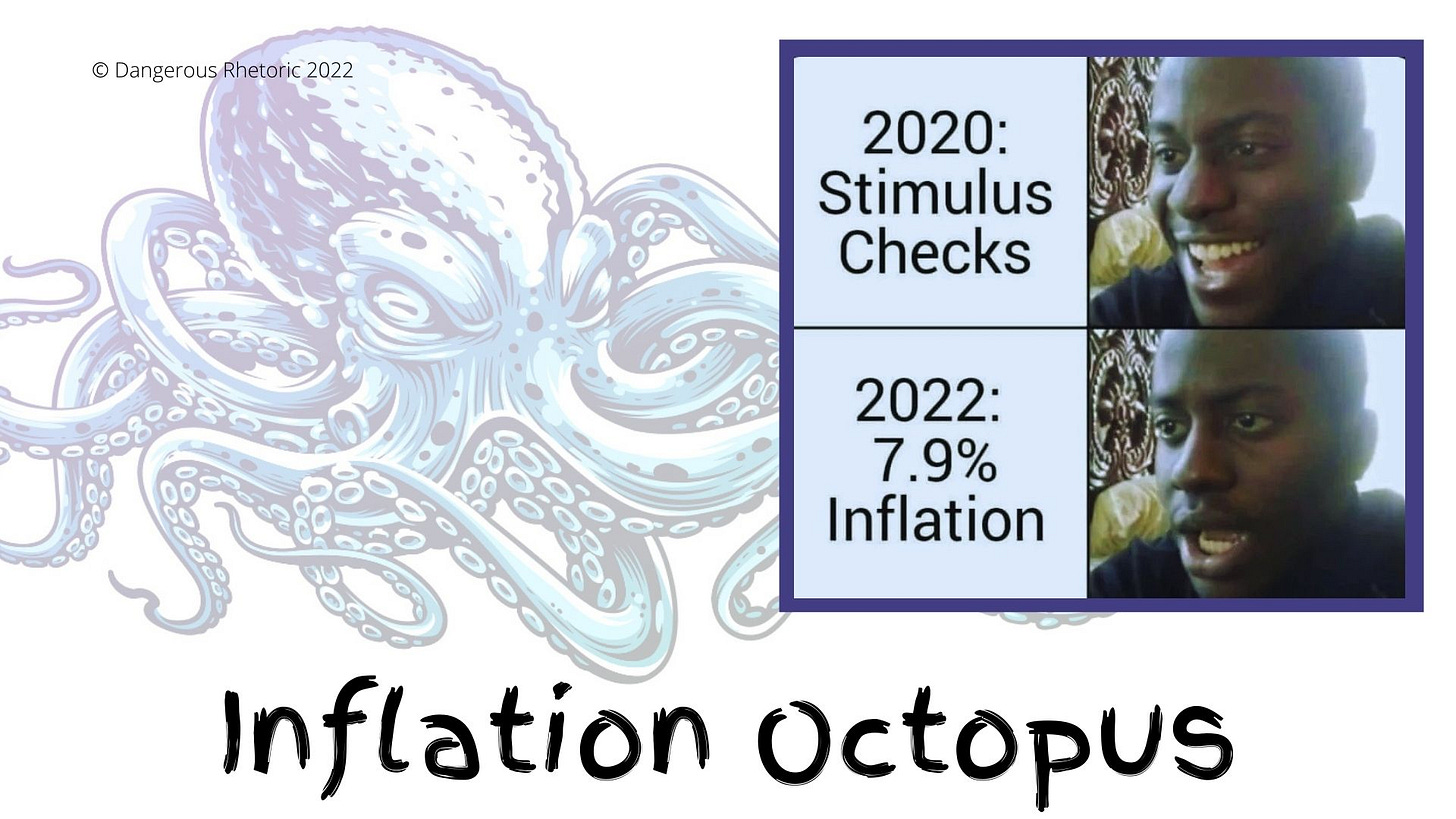

This explains why politicians and the monetary policy makers at the federal reserve might really want inflation! Governments all over the world are the largest debtors. It’s a race to the bottom, as they’d like to pay back their debts with money that is worth less than what they borrowed! All policy makers have to do is push a button, create “stimulus” and funnel the magic money into war zones, humanitarian aid, or climate justice projects. They don’t care how inflation impacts the day-to-day life of ordinary working people.

Victor Davis Hansen, writing for The Independent Institute, predicts that the Democrats will suffer historic losses in the mid-term elections, and “the culprit for the political wipeout will be out-of-control inflation” (https://bit.ly/3qhYoVi).

Hansen rightly points out the following problems: “First, the Biden Administration is in such denial of inflation that it sounds to Americans simply callous and indifferent to the misery it has unleashed.” In addition, the administration says that prices are “only rising at an annualized rate of 7.5 percent—as if the steepest increase in 40 years actually is not all that bad... Yet the middle class knows that inflation is far worse when it comes to the stuff of life: buying a house, car, gas, meat, or lumber.”

He continues, “...inflation is an equal opportunity destroyer of dreams. It undermines rich and poor, Democrats and Republicans, conservatives and liberals. It unites all tribes, all ideologies, all politics against those who are perceived to have birthed the monstrous octopus that squeezes everything and everyone it touches.”

And while the term “Bidinflation” has a nice ring to it, it gives the current U.S. president too much credit. Our current inflation octopus has been created by the banking system, the Federal Reserve, progressive policy makers, and ALL politicians who think they can spend their way to a new totalitarian one-world-government utopia.

Unfortunately, when the United States economy collapses under runaway inflation, working people all around the world will pay the price for these dangerous and irresponsible progressive policies for years to come. Get ready for the coming hard times, and roll up your sleeves to do what you can to restore the rule of law and our constitutional republic. Together, we can make America great again.

Nancy Churchill is the state committeewoman for the Ferry County Republican Party. The opinions expressed in Dangerous Rhetoric are her own. She may be reached at DangerousRhetoric@pm.me.